Thursday Links

Iron & Brick, Brooklyn Heights. Photo by ClatieK Market for Brooklyn Town Houses Soars [NY Times] Property Taxes Rising Too Fast [NY Times] All In The Planning [NY Times] Brooklyn Graffiti Artist Busted [NY Post] Fuel-Driven Rent Hike? [NY Post] Marching to Save Church [NY Daily News] City Council DOB Task Force [NY Daily News]…

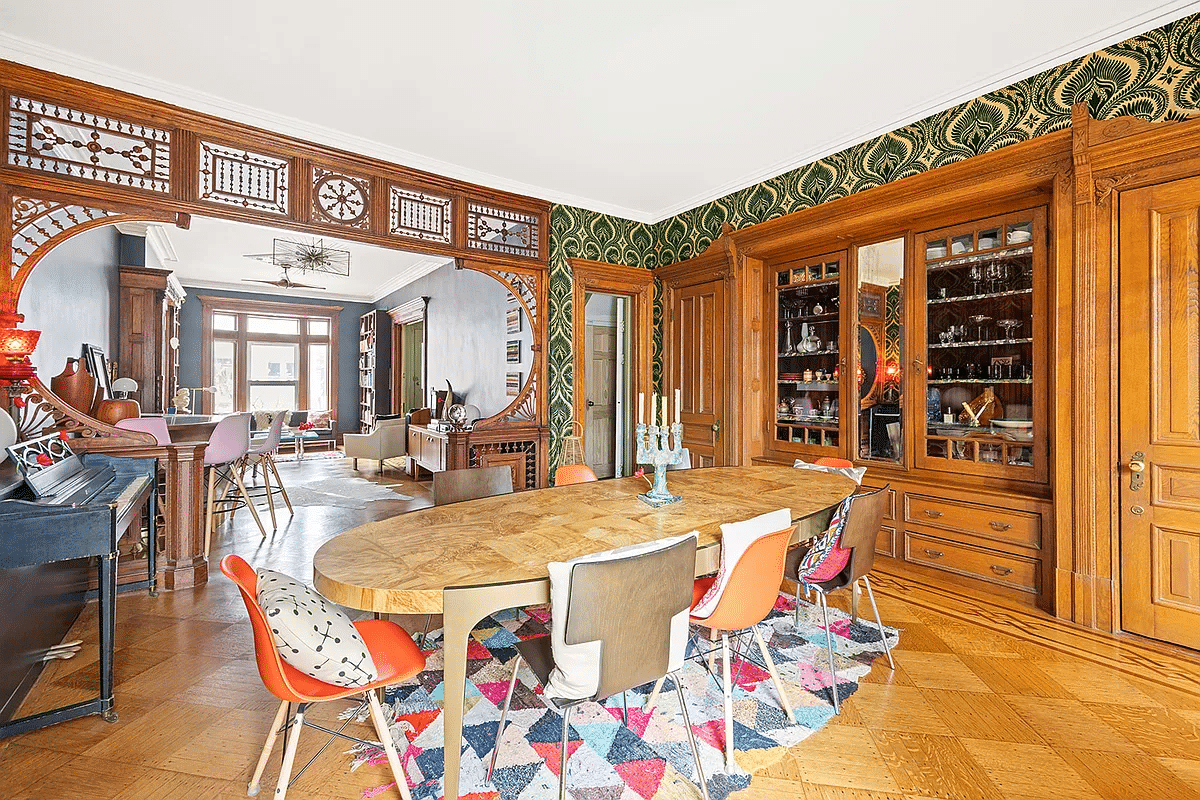

Iron & Brick, Brooklyn Heights. Photo by ClatieK

Market for Brooklyn Town Houses Soars [NY Times]

Property Taxes Rising Too Fast [NY Times]

All In The Planning [NY Times]

Brooklyn Graffiti Artist Busted [NY Post]

Fuel-Driven Rent Hike? [NY Post]

Marching to Save Church [NY Daily News]

City Council DOB Task Force [NY Daily News]

Magnetic Chalkboard Refrigerator [House in Progress]

Agnes and Hoss Lighting [Design*Sponge]

Trader Joe’s in Brooklyn? [Curbed]

Clinton Hill’s Broken Angel [Gothamist]

Sunny’s in Red Hook [A Brooklyn Life]

great,

let me get back in my “way back” time machine and i can buy all of carroll gardens

Everybody wishes they bought google at 85 too. Opportunities come everyday, you just have to look for it.

When I was in grad school, I lived on the corner of Pacific and Dean. This was in 1992. Brownstones then were going for roughly $300k. What a missed opportunity! I shouldn’ve skipped b-school, worked two jobs, washed cars on weekends and bought a damn house!

Sorry Mr. B but this article is a downer for those who didn’t buy in that area in the early to mid 1990’s. I know now that it’s all about location but who would’ve known then that this area would become the “it” location in 10-15 years! When I finally did buy I thought that I was a genius for buying in Clinton Hill and saving $50-$100k on the purchase price relative to townhouses west of Flatbush Avenue! Arrrgggghhh!!!

>;-(

Ha! I guess I should be having another cup of coffee. Although, I was confused by the million dollar home in Cobble Hill, it didn’t dawn on me to look at the date of the article. You got me.

that article makes me want to cry

NYTimes Article: Lovely blast from the past. Hard to believe that less than 9 years ago you could get a Bhill house for less that it costs to buy in Bed-stuy.

Just providing a little historical perspective and seeing who’s awake 😉

Wow a boerum hill four family for 430,000

I think articles about the tax burden:

“New York State residents are paying the highest property taxes in the country, increasing at triple the rate of inflation over the last five years, according to a report released on Wednesday by the state comptroller. Suburban homeowners, the report said, bear the biggest burden.”

are a pointer to excessively inflated prices for property, as the tax burden is calculated as a percentage of something like the “market value” of the house – albeit increasing much more slowly than that assessed value.

So this indicates that most people could not afford to re-buy their own homes at their current market prices, as they are finding it difficult to even pay the legitimate tax that accrues on the inflated value. Property tax is not supposed to be so large that it is painful.

What is next: cost of insurance, cost of repairs, cost of maintenance.

Something has to give. Either prices go back to something reasonable, or 90% of people move to the midwest and leave their houses for the supposedly many super rich floating around new york who don’t notice property tax, or million dollar mortgages.